The Best Strategy To Use For Medicare Graham

Wiki Article

Medicare Graham Fundamentals Explained

Table of ContentsMedicare Graham Can Be Fun For AnyoneMedicare Graham for BeginnersThe smart Trick of Medicare Graham That Nobody is DiscussingOur Medicare Graham DiariesWhat Does Medicare Graham Do?

Prior to we speak about what to ask, allow's talk about that to ask. There are a great deal of ways to authorize up for Medicare or to get the information you require before picking a plan. For lots of, their Medicare trip begins directly with , the official website run by The Centers for Medicare and Medicaid Solutions.

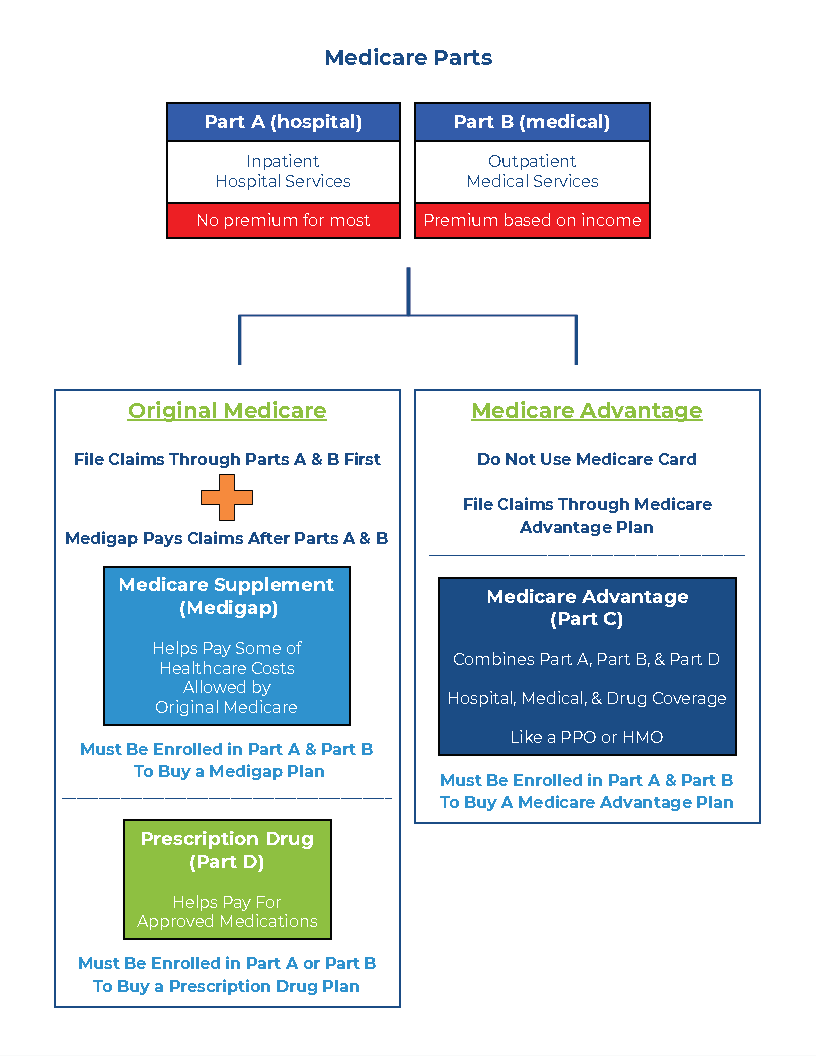

It covers Part A (health center insurance policy) and Component B (clinical insurance). These plans function as a different to Initial Medicare while offering more advantages.

Medicare Component D plans assistance cover the expense of the prescription medications you take at home, like your daily medicines. You can sign up in a different Component D strategy to include medicine insurance coverage to Original Medicare, a Medicare Price strategy or a couple of various other types of plans. For several, this is often the initial question taken into consideration when searching for a Medicare plan.

Rumored Buzz on Medicare Graham

To get one of the most cost-effective health and wellness treatment, you'll want all the solutions you make use of to be covered by your Medicare plan. Some covered services are completely complimentary to you, like mosting likely to the medical professional for preventative care testings and tests. Your strategy pays whatever. For others like seeing the medical professional for a remaining sinus infection or loading a prescription for protected antibiotics you'll pay a charge.

, as well as insurance coverage while you're traveling locally. If you plan on taking a trip, make sure to ask your Medicare expert regarding what is and isn't covered. Possibly you have actually been with your current physician for a while, and you desire to keep seeing them.

Top Guidelines Of Medicare Graham

Lots of individuals that make the switch to Medicare continue seeing their routine medical professional, yet for some, it's not that basic. If you're dealing with a Medicare advisor, you can inquire if your physician will certainly remain in network with your brand-new plan. However if you're considering strategies independently, you might have to click some web links and make some calls.For Medicare Advantage strategies and Expense strategies, you can call the insurer to see to it the medical professionals you desire to see are covered by the plan you have an interest in. You can likewise check the strategy's website to see if they have an on the internet search device to find a protected physician or center.

Which Medicare plan should you go with? Beginning with a checklist of factors to consider, make sure you're asking the appropriate inquiries and start concentrating on what type of strategy will certainly best offer you and your requirements.

The Greatest Guide To Medicare Graham

Are you about to transform 65 and come to be newly qualified for Medicare? Selecting a plan is a large decisionand it's not constantly a simple one. There are essential things you should know in advance. For instance, the least pricey strategy is not always the most effective alternative, and neither is the most pricey plan.Also if you are 65 and still functioning, it's an excellent idea to assess your options. Individuals getting Social Safety and security benefits when turning 65 will certainly be instantly enrolled in Medicare Parts A and B. Based on your work situation and wellness treatment options, you might need to consider signing up in Medicare.

Original Medicare has 2 components: Component A covers a hospital stay and Component B covers medical expenditures.

Our Medicare Graham Statements

There is typically a costs for Component C policies in addition to the Part B costs, although some Medicare Benefit plans deal zero-premium plans. Medicare South Florida. Testimonial the protection information, prices, and any fringe benefits used by each plan you're thinking about. If you enroll in initial Medicare (Components A and B), your costs and coverage will certainly coincide as other individuals that have Medicare

(https://hubpages.com/@m3dc4regrham)This is a set quantity you may have to pay as your share of the expense for care. A copayment is a set amount, like $30. This is one of the most a Medicare Advantage member will certainly need to pay out-of-pocket for covered solutions annually. The amount differs by plan, yet as soon as you get to that restriction, you'll pay absolutely nothing for covered Component A and Part B solutions for the remainder of the year.

Report this wiki page